Introduction:

Retirement is often seen as the golden years—a time to relax, explore new passions, and enjoy life without the daily grind of work. But have you ever stopped to think about how you’ll fund this dream? Many people underestimate the importance of retirement income planning or rely on traditional methods that may not stand up in today’s economic climate. With rising costs and uncertain markets, it’s crucial to rethink your approach to generating income during retirement. Let’s reshape our understanding and delve into fresh strategies that could secure a more comfortable future for you.

Traditional Retirement Income Planning vs. A Fresh Mindset

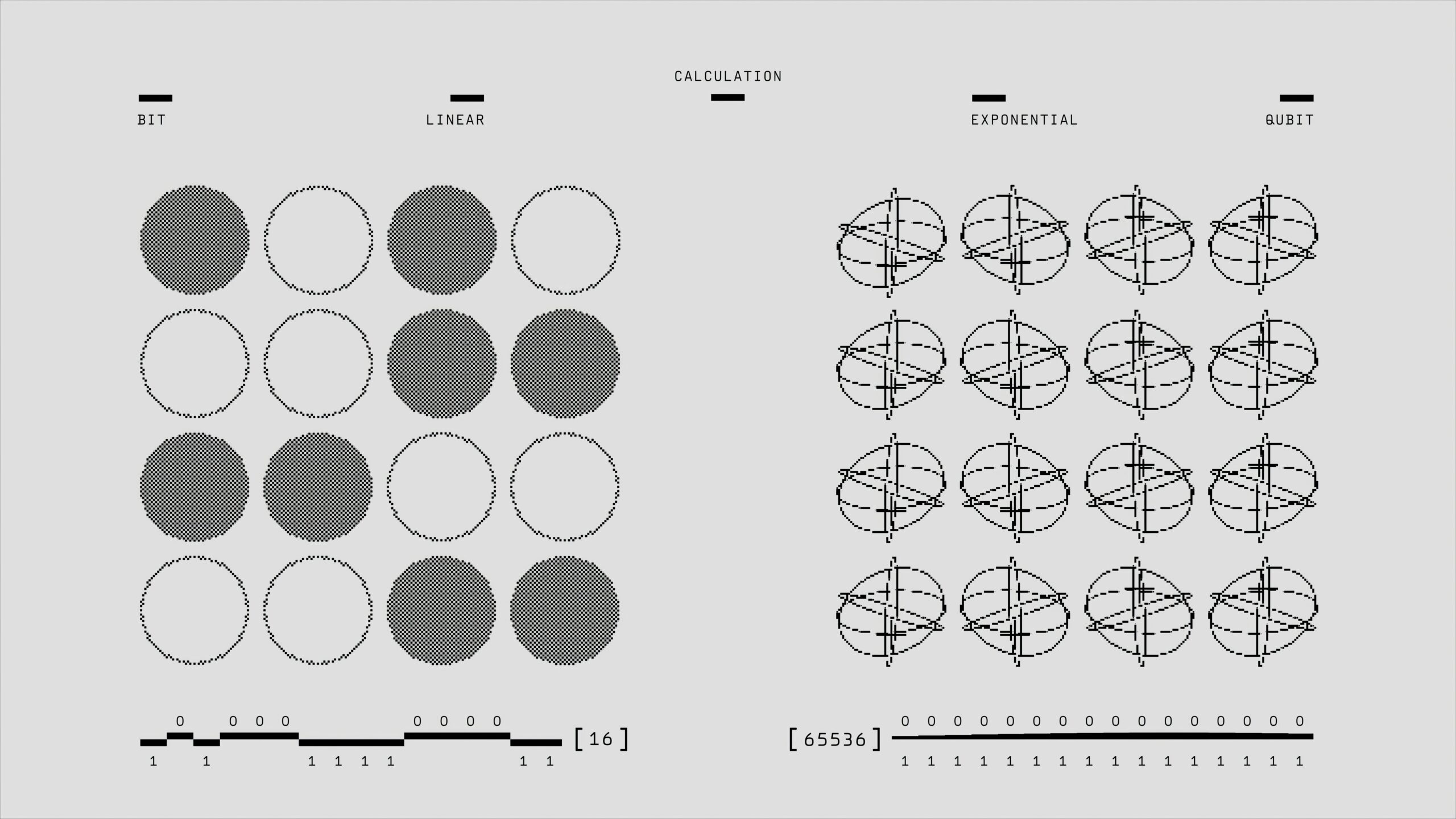

Traditional retirement income planning often relies heavily on a fixed strategy. Many people depend solely on savings accounts, pensions, or Social Security. This approach can feel safe but may not meet the diverse needs of today’s retirees.

A fresh mindset embraces change and flexibility. It recognizes that life is unpredictable and financial landscapes are constantly shifting. Instead of a one-size-fits-all solution, this modern perspective encourages individuals to explore creative options.

Consider the gig economy. Part-time work offers a way to supplement income while staying engaged with interests or passions. Additionally, investing in assets like rental properties can provide ongoing cash flow.

Rethinking retirement means prioritizing adaptability over rigidity. It invites you to craft a plan tailored specifically for your unique situation and goals, ensuring you’re prepared no matter what twists life throws your way.

– Explaining the difference and why traditional methods may not be effective

Traditional retirement income planning often relies heavily on a one-size-fits-all approach. This method typically emphasizes saving in a 401(k) or relying solely on Social Security benefits. While these tools have their merits, they can leave retirees vulnerable to market fluctuations and inflation.

Many individuals follow outdated strategies without considering their unique circumstances. What worked for previous generations may not fit today’s economic landscape. Factors like longer life expectancies and rising healthcare costs demand new thinking.

Additionally, traditional methods often overlook the importance of flexibility in income streams. Relying exclusively on fixed sources limits adaptability during unforeseen events—like unexpected medical bills or changes in living situations.

A fresh mindset encourages more dynamic planning that reflects individual goals, preferences, and risk tolerance levels. By exploring innovative options beyond conventional wisdom, future retirees can better secure their financial well-being throughout their golden years.

The Importance of Diversifying Your Retirement Income Sources

When planning for retirement, relying on a single source of income can be risky. Diversifying your retirement income sources helps to create financial stability and peace of mind.

Consider various avenues such as investments, rental properties, or even part-time work. Each option offers unique benefits that can enhance your overall financial picture.

Investments in stocks or bonds may provide growth potential while rentals can generate steady cash flow. Additionally, part-time work allows you to stay engaged without overextending yourself.

Having multiple streams means you’re less vulnerable to market fluctuations or unexpected expenses. If one source underperforms, others may compensate.

This approach ensures that you have the resources needed to enjoy your retirement years fully and comfortably. Embrace variety in your income strategy for a more secure future ahead!

– Examples of different sources such as investments, rental properties, part-time work, etc

When considering retirement income, it’s essential to explore various avenues beyond traditional savings. Investments can play a crucial role. Stock portfolios or mutual funds may provide substantial returns over time.

Rental properties offer another option. Owning real estate allows you to benefit from rental income while building equity in the property itself. It’s an investment that can generate passive cash flow.

Part-time work is also worth noting. Many retirees find fulfillment and extra income through part-time jobs or freelance gigs. This not only helps financially but keeps you engaged and active.

Don’t overlook other sources like annuities or peer-to-peer lending platforms, which can diversify your portfolio further. Each of these options contributes uniquely to creating a stable financial future during retirement years, ensuring you’re well-prepared for what lies ahead.

How to Create a Sustainable Retirement Income Plan

Creating a sustainable retirement income plan starts with understanding your needs and desires. Think about the lifestyle you envision. Will you travel? Spend more time with family? Knowing what brings you joy helps shape your financial path.

Next, calculate potential expenses. Factor in regular costs like housing, healthcare, and leisure activities. Don’t forget unexpected expenses; they can arise at any moment.

After identifying your spending habits, explore various income sources. Social Security might be one part of it, but think bigger—investments can provide dividends or interest income over time.

Rental properties offer another avenue for consistent cash flow while building equity. Perhaps consider part-time work if you’re looking to stay active and engaged post-retirement.

All these elements together form the backbone of a robust plan that adapts as life changes unfold.

– Identifying your needs and wants for retirement

Understanding your needs and wants for retirement is essential. Start by envisioning your ideal lifestyle. Will you travel? Perhaps spend more time with family or take up new hobbies?

Next, assess your current financial situation. What income will you require to support those dreams? Think about daily expenses, healthcare costs, and leisure activities.

Consider the difference between essentials and desires. Your essentials are non-negotiable—housing, food, transportation—while desires can be flexible based on budget constraints.

Reflect on how long you anticipate living in retirement. This foresight helps gauge the total income needed over the years ahead.

Engaging in this reflective process not only clarifies what matters most but also sets a solid foundation for effective planning moving forward. Balancing needs against wants creates a roadmap that aligns with both aspirations and reality.

– Calculating potential expenses and sources of income

Calculating potential expenses and sources of income is crucial for a sustainable retirement. Start by assessing your lifestyle needs. Consider where you want to live, how you plan to spend your time, and what activities bring you joy.

Next, create a detailed budget that outlines both essential and discretionary expenses. Factor in healthcare costs, housing payments, travel plans, hobbies, and any other anticipated expenditures.

After identifying these costs, it’s time to determine your income streams. List all possible sources: Social Security benefits, pensions if applicable, investment returns from stocks or bonds, rental income from properties you may own or even part-time work that aligns with your interests.

Calculate how much each source can contribute toward meeting your estimated expenses. This will help highlight any gaps between expected income and desired spending.

By taking this thorough approach to planning for retirement income now rather than later will empower you to enjoy the freedom that comes with financial security during this important life stage.